Speaking

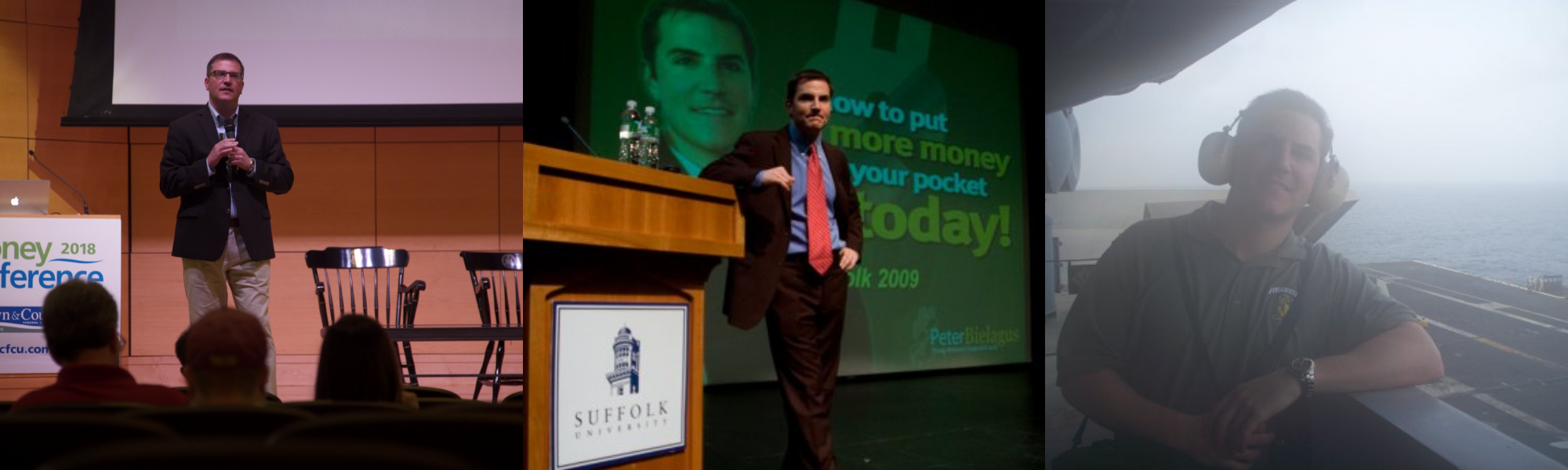

Interested in having Peter speak to your group?

Here are 4 things to remember...

No Sales Pitch

Peter does not sell any financial products. Many “free” financial speakers are only there to give your audience a sales pitch. Aside from books, there is nothing to buy at Peter’s presentations.

Customizable

All programs are customized to your group. Don’t see your ideal topic here? Give us a call or send us an email and we’ll design the exact presentation you want. We have even assisted organizations in getting Peter’s presentations qualified for continuing education credits in their industry!

Online or In Person

Peter can present any of his interactive presentations online or in person.

All Day

Peter is an all-day speaker. When you engage Peter, he is available for the entire day. He is able to do multiple presentations, meet with individuals or small groups and even conduct interviews for your media. Have an idea? Just ask!

Peter loves speaking to...

Colleges

According to a recent study conducted by the Bill and Melinda Gates Foundation, money management problems are now the #1 reason for college dropouts. Don’t lose students to financial problems. Let Peter help today!

College Speech Topics

- Jumpstart Your College Finances

- The Desert Island Dilemma

According to the Bill and Melinda Gates Foundation, money management issues are now the NUMBER ONE reason students drop out of college. In this fun and informative session, money management expert, Peter Bielagus, delivers financial tips and tricks—from crypto to credit—that any student of any financial background can use to improve their financial life.

Key Takeaways and Skills Gained:

- Learn the two most important numbers around student loans.

- Understand what a credit score is, how it works, and how to improve it.

- Explore three ways to increase your credit score.

- Examine the number one reason why most budgets fail and what to do about it.

- Dissect the stock market, how it works, and how students can get started.

Perfect for: Orientation, Weekday Assembly, Parent’s Weekend, Student Seminars, Leadership Training

Note: Peter can present this as a “mixed” session, focusing half the presentation on college finances and half the presentation on college success. This can also be presented to mixed parent/student audiences

The Desert Island Dilemma: (Why Your Retirement Plan Won’t Work The Way You Think It Will)

Imagine you are stranded on a desert island with only ONE barrel of water. How much do you drink every day? If you knew when you would be rescued and when it was going to rain, you could set out a plan. But since you don’t know, your default plan is to drink the smallest amount of water possible to ensure it will last.

The same problem occurs in your retirement planning. You don’t know how long you are going to live, and you don’t know how the stock market will perform. So, you withdraw the smallest amounts of money possible from your retirement account to ensure your money will last.

In this eye-opening session, audiences will learn why their current retirement plan won’t work the way they think it will and what they can do about it.

Key Takeaways and Skills Gained:

- Understand the historic shift of modern retirement planning (from guaranteed benefit to guaranteed contribution; from planning in a pool of many to planning in a pool of one.)

- Develop a strategy to make a predetermined amount of money last for an undetermined amount of time.

- Explore why retirement planning is not about money; it’s about income.

- Discover the retirement planning options beyond the 401k, the 403b and the IRA.

- Learn how to take advantage of mortality credits and move from planning in a pool of one to a pool of many.

Perfect For: Faculty and Staff Training, Lunch and Learn, Parents Weekend, Grad School Events, Professional Development

High Schools / Youth

Think high school students don’t care about personal finance? Think again. Peter has spoken at high schools all over the world inspiring students to take charge of their financial lives.

High Schools/Youth Speech Topics

- Is College Worth It?

- Making Finance Fun

College can be one of the most rewarding experiences a student can undergo. But it can also be one of the most expensive. As millions of college grads suffer under enormous debt, the question has to be asked:

Is college worth it?

In this candid conversation, Peter examines all sides of the higher education equation. He’ll discuss costs versus future earnings and review the various options: state schools, private schools, community colleges, trade schools, military options, and online education.

Key Takeaways and Skills Gained:

- Learn the simple equation to determine how much you can afford to borrow.

- Discover the options beyond a four-year degree.

- Understand why most parents and students overpay for college.

Perfect For: College Night, Parent’s Night

Peter has delivered over 1000 paid presentations at colleges and universities. Every one of those colleges and universities had a finance professor or a local bank representative that could have spoken to the students for free.

So why do colleges pay Peter for something they can get for free? Easy.

He makes finance fun.

Peter doesn’t just educate; he inspires people to take immediate action on their financial lives.

For the past twenty years, Peter’s unique approach to financial education has brought him all over the world.

Care to know how he does it? Want to learn how he gets audiences of all ages excited about managing their money?

In this tell all session, Peter will reveal all his from the stage secrets for teaching personal finance.

Key Takeaways and Skills Gained:

- Learn the top technique Peter has used for the past twenty years to get students excited about money management.

- Explore the top three “hot topics” that are most appealing to young audiences.

- Discover the simple technique that Peter uses to explain complex financial topics.

Perfect for: Professional Development, Faculty and Staff Training, Lunch and Learn, Continuing Education Credits, Financial Literacy Conferences

Note: Please give us a call to see how we can create a custom presentation for you where your members can earn Continuing Education or Professional Development Credits in their industry.

Educators

Over 500 colleges, universities, and high schools have hired Peter to speak to their students for one simple reason: he makes finance fun. Peter doesn’t just push a pile of information across a table. He presents financial information in a way that makes people of all ages and backgrounds want to take immediate action. Want to know how he does it? In this “spill the beans train the trainer session,” Peter lets out all of his secrets on how he inspires audiences of all ages and backgrounds to take immediate action on their financial lives.

Educator Speech Topics

- Money In the Movies

- Jumpstart Your Finances

Peter’s hit YouTube show Money In the Movies is now a presentation! Peter has reviewed almost 100 movies for their financial accuracy. Every week he posts a new show, revealing a new movie’s facts and flaws, and uncovering the financial lessons inside the film.

What’s more, every Money In The Movies episode has a corresponding curriculum that can be used in the classroom or for independent study!

In this high energy presentation, Peter will show audience members the subtle money messages in our favorite movies.

Key Takeaways and Skills Gained:

- Learn what Batman can teach us about the stock market.

- Discover what James Bond can teach us about investing.

- Understand what Jason Bateman and Melissa McCarthy can teach us about identity theft.

- Audiences will be amazed at just how much they can learn about money from their favorite movies!

Perfect for: Professional Development, Financial Literacy Conferences, Continuing Education Sessions

According to the Bill and Melinda Gates Foundation, money management issues are now the NUMBER ONE reason students drop out of college. In this fun and informative session, money management expert Peter Bielagus serves up financial tips and tricks that any student of ANY financial background can use to improve their financial life.

Key Takeaways and Skills Gained:

- Learn the two most important numbers around student loans.

- Understand what a credit score is, how it works, and how to improve it.

- Explore the three biggest money mistakes students make when they leave high school.

- Dissect why most budgets don’t work and what to do about it.

- Explore the stock market, how it works and how students can get started.

Perfect for: Weekday Assembly, Parent’s Night, College Night, Financial Literacy Conferences, Leadership Training

Corporate / Associations

Would your company or association benefit from more productive employees or members? Money troubles are the #1 reason for divorce in the United States. They also contribute to higher employee turnover, lower productivity, and even higher employee theft. Let Peter help the people in your organization get on firm financial ground, and see the looks of stress and worry disappear.

Corporate/Assocations Speech Topics

- The Desert Island Dilemma

- Jumpstart Your Finances

- Grow Your Business

The Desert Island Dilemma: Why Your Retirement Won’t Work The Way You Think It Will

Imagine you are stranded on a desert island with only ONE barrel of water. How much do you drink every day? If you knew when you would be rescued and when it was going to rain, you could set out a plan. But since you don’t know, your default plan is to drink the smallest amount of water possible to ensure it will last.

The same problem occurs in your retirement planning. You don’t know how long you are going to live, and you don’t know how the stock market will perform. Your only solution seems to withdraw the smallest amounts of money possible from your retirement account to ensure your money will last.

But there are options.

In this eye-opening session, audiences will learn why their current retirement plan won’t work the way they think it will and what they can do about it.

Key Takeaways and Skills Gained:

- Understand the historic shift of modern retirement planning (from guaranteed benefit to guaranteed contribution; from planning in a pool of many to planning in a pool of one.)

- Develop a strategy to make a predetermined amount of money last for an undetermined amount of time.

- Explore why retirement planning is not about money; it’s about income.

- Discover the retirement planning options beyond the 401k, the 403b and the IRA.

- Learn how to take advantage of mortality credits and move from planning in a pool of one to a pool of many.

Perfect For: Lunch and Learn, Employee Appreciation Events, Staff Training, Professional Development

With money management problems being a key contributor to employee stress, the number one reason for divorce and the number one reason for college dropout, it makes sense for companies and associations to invest in financial education.

According to a recent article by the Society of Human Resources Management, Financial Literacy Programs can “help companies hold onto their workforces.” These programs can also “boost productivity and cut healthcare costs.”

No matter where your employees or members are in their financial lives, everyone can use a financial jumpstart. Whether an audience member just started their professional career or they can see retirement on the horizon, Peter will offer insights that your members and employees can use to immediately improve their financial lives.

Key Takeaways and Skills Gained:

- Discover the easiest way to increase your credit score.

- Learn how to maximize the resources available at your company or in your organization.

- Understand why your tax favored retirement plan doesn’t work the way you think it does, and what to do about it.

Perfect For: Lunch and Learn, Employee Appreciation Events, Professional Development

For the past twenty years Peter has presented to entrepreneurs big and small. From the “All-I-have-is-an-idea-and-my-passion” to the multi-million dollar business owner, Peter can help entrepreneurs at any stage of business ownership take their dream to the next level.

Key Takeaways and Skills Gained:

- Why businesses need to put cash flow FIRST and how to do it.

- Show me the money: Identify non-traditional sources for financing (either for startup or expansion.)

- Implementing the Scared Rule of Three to expand your business.

Perfect for: Entrepreneur Groups, Small Business Seminars, Networking Events

The Military

In a 2016 USAA/Blue Star Families survey, 63% of military respondents were experiencing stress due to their current financial situations and 37% of respondents felt insecure about their financial futures.

A 2019 Military Financial Readiness Survey sponsored by Wells Fargo and NFCC revealed that “servicemembers and spouses/partners are more likely than the general US population to be behind on bill payments.”

For the past twelve years, Peter has worked with all branches of the armed forces, and has delivered financial presentations to servicemembers in Bahrain, Italy, Greece, Spain, Korea, Japan, Hawaii and many states. Peter’s presentations are a big success on military bases because he understands the unique challenges that servicemembers face and he has the ability to make finance fun.

Military Speech Topics

- Military Millionaires

- Making Finance Fun: A Train the Trainer Session

- TSP Tragedy: Why You’re Using Your TSP Wrong, and What To Do About It

Wait, is that even possible? It is! Peter has traveled all over the world speaking to servicemembers from all branches of the United States Military. During his travels, he’s met thousands of Military Millionaires and even more soon-to-be millionaires. He’ll share the advice he’s heard from service members, plus he’ll serve up the latest financial tips and tricks to ensure that all who serve have a strong financial life.

Key Takeaways and Skills Gained:

- Learn the three most powerful wealth building tools in the servicemember’s arsenal.

- Learn the three biggest mistakes servicemembers make with their finances.

- Understand how to take full advantage of what the military offers.

Perfect for: Military Saves Week, Officer/Enlisted Trainings, Professional Development

The United States Military has brought Peter all over the globe to teach to financial education to servicemembers. Why would the military pay for this? Simple: Peter makes finance fun. He presents information in a way that inspires those who serve to take immediate action on their financial lives.

In this tell all train the trainer session, Peter will reveal the secrets he uses to get serves members excited about personal finance.

Key Takeaways and Skills Gained:

- Learn three simple tips to convince junior servicemembers not to buy that car.

- Discover the secret to inspiring a mindset change for a younger servicemember from short-term thinking to long term thinking.

- Explain the financial benefits of military service.

Perfect for: Officer Trainings, Military Saves Week

The Thrift Savings Plan (TSP) is one of the most powerful wealth building tools available to servicemembers. Yet many servicemembers aren’t using the TSP correctly. Unfortunately, many will discover this too late.

In this eye-opening session, servicemembers will learn why their current retirement plan won’t work the way they think it will and what they can do about it.

Key Takeaways and Skills Gained:

- Understand why retirement planning is not about money; it’s about income.

- Explore the best approach to maximize the potential of your TSP.

- Define your exit strategy—learn how to convert your TSP into an income producing investment for your retirement.

Perfect For: Military Saves Week, Officer/Enlisted Trainings, Professional Development

“As a senior at Souhegan High School, I was able to attend your lecture about personal finance a little over a month ago. I was very impressed with your presentation and found that I, like many of my peers, enjoyed it very much. I think that the presentation was such a success because you were able to break down the concepts of personal finance into simple, practical steps. Throughout the lecture you concisely told us what we ought to do and why we should do that. I found this sort of break-down very helpful in understanding the concepts.”

Shaun G.

Souhegan High School; Amherst, NH

“I’m not gonna lie, I went to your presentation because we had to attend it for my personal finance class so we could write a paper on it but I am thrilled that I ended up going.

The AHA moment of your presentation for me was when you were talking about credit reports. I knew of credit reports and credit scores but I had no idea that there were easy ways to look them up and there were common mistakes in them. When I heard that I was happy to know that I was able to control something like that on my own because more often than not those types of things can be hard to control.”

Chris G.

Southern NH University; Manchester, NH

“The energy and style with which you present is definitely appealing to a college audience! Your presentation was surely an eye-opening one. My “aha moment” was the entire presentation. Due to the fact that my father is also a financial advisor, I’ve always had him deal with the investing side of my finances, and thus far it has served me well. However, your presentation last night made me “wake up and smell the coffee” so to speak. I now realize the importance of managing my own finances and maybe reading my statements and reports a little closer. After all, it is my money and ultimately my life.”

KellyMarie D

Wesley College; Dover, Delaware